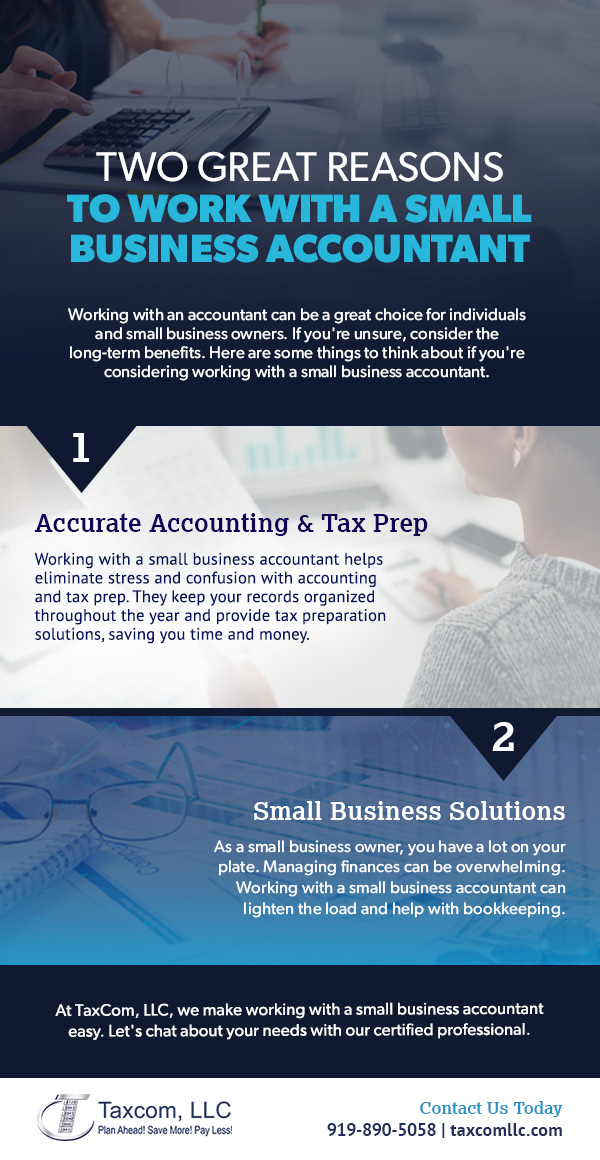

Sometimes working with an accounting professional can be the best choice for individuals and small business owners. If you’ve been on the fence about working with small business accountant, you might find it is one of the better choices for yourself and your business in the long-term. Here are some important considerations if you are thinking about working with a small business accountant for the first time.

- Accurate Accounting & Tax Prep- By choosing to work with a small business accountant, you can eliminate some of the stress and confusion that comes with accounting and tax preparation. A small business accountant not only keeps your financial records in order during the year, but they will also assist you with tax preparation solutions. This important step can save time and money and give you confidence your financial and tax documents are in order.

- Small Business Solutions- As a small business owner, you already ] have a lot on your plate throughout the year. After all, the most important thing you do is serve your customers and provide important services in your community. One of the things that can often get small business owners bogged down is trying to manage all of their financial recording in addition to all of the regular work that must be done. Working with a small business accountant can eliminate some of the day-to-day struggles associated with bookkeeping for your business.

At TaxCom, LLC, we understand that working with a small business accountant might feel like a big step. The good news is that we can simplify the process and provide all of the accounting and tax prep solutions you need. Contact us today to discuss your requirements with a certified professional.